Online Money Tips -

Save Money with Free Budgeting Apps

Online Money Tips

Save Money with Free Budgeting Apps

/en/online-money-tips/what-are-contactless-payments/content/

People often think of starting a new budget as something you do when you're saving for a specific goal or making a New Year's resolution. But the truth is you can start taking charge of your spending anytime!

There are many ways to create a budget, but if you're new to the whole thing you might consider using a budgeting app. These apps can do a lot of the math and expense tracking for you, which leaves you with more time and energy to focus on actually saving money. We're going to take a look at a few of the most popular budgeting apps.

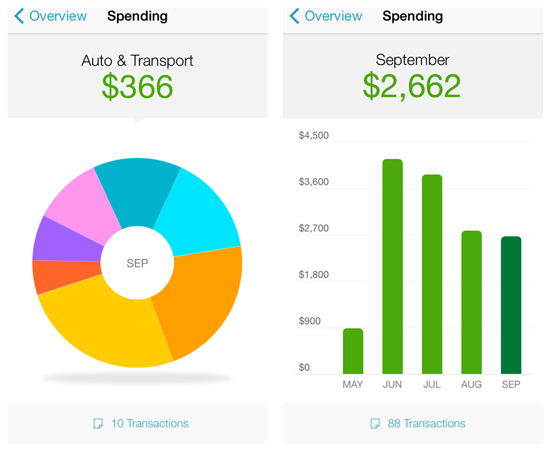

Mint is one of the most comprehensive free budgeting tools out there. After you've given it permission to look at your bank transactions, Mint automatically sorts your expenses into categories like groceries, restaurants, and bills. This helps you understand exactly what you're spending money on, which should also make it easier to decide which expenses to cut. Once you've decided how much you want to spend, you can set a detailed budget with limits on each spending category.

Mint does an excellent job of visualizing your data. It automatically creates beautiful charts and graphs that let you see your spending habits and history at a glance. Mint also does a really good job of sending alerts when something's wrong, like if you've overspent or if your bank has charged you a fee.

That said, Mint has a few drawbacks. First, it has so many features that you might find it overwhelming. Second, while Mint is supposed to automatically categorize your spending expenses it doesn't always get all of them right. Because Mint relies on these categories to track your spending, you'll need to do this part manually from time to time.

These faults are minor, though. If you're looking for a budgeting tool that will give you a fine-grained look at your spending habits, Mint is a great choice, especially if you're willing to put in some time to set it up correctly.

There are many other budgeting apps to choose from. Each one has a different set of features, and depending on your needs you may prefer one that has more features or a simplified interface. Although some budgeting apps are free, others require a monthly subscription. Below are a few free apps:

Remember, there's no "best" budget app—you should choose the one that works best for you. If you have a fairly complex financial situation, Mint might be the best choice. If you are just getting started with saving, PocketGuard's simple focus can help you change your habits quickly. You may even want to try more than one app to see which one is the best fit for you.

/en/online-money-tips/ditch-your-cable-and-stream-tv-for-much-less/content/